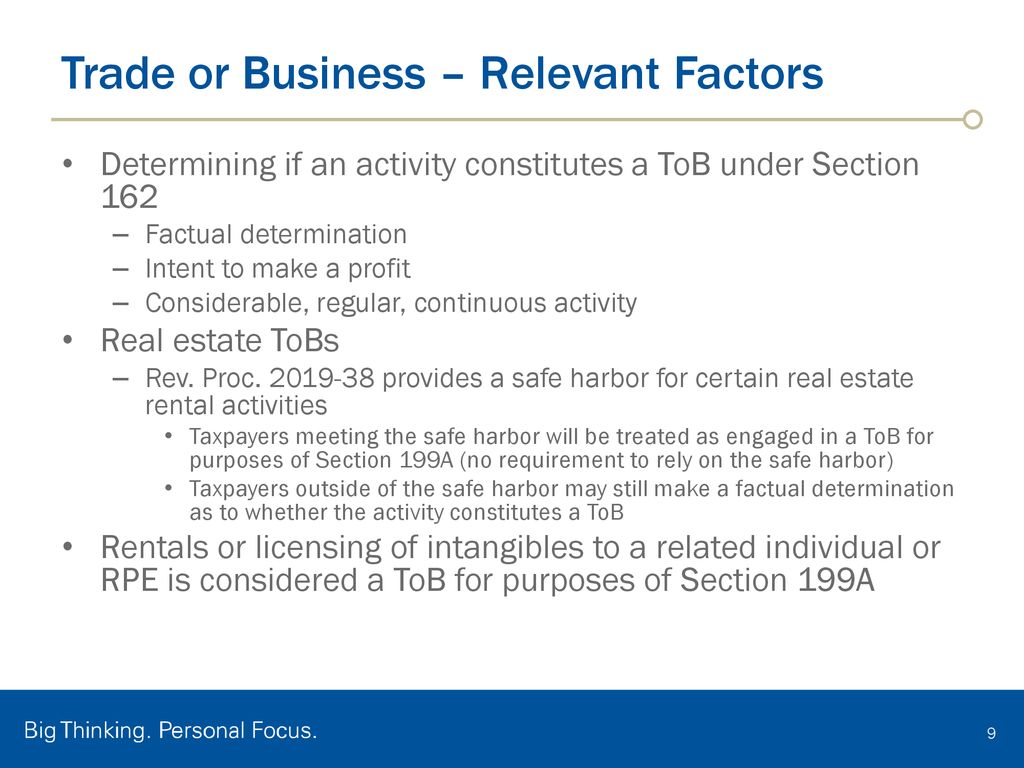

Part I Section 162.–Trade or Business Expenses 26 CFR 1.162-1: Business Expenses (Also §§ 118, 165, 301, 801, 831; 1.118-1,

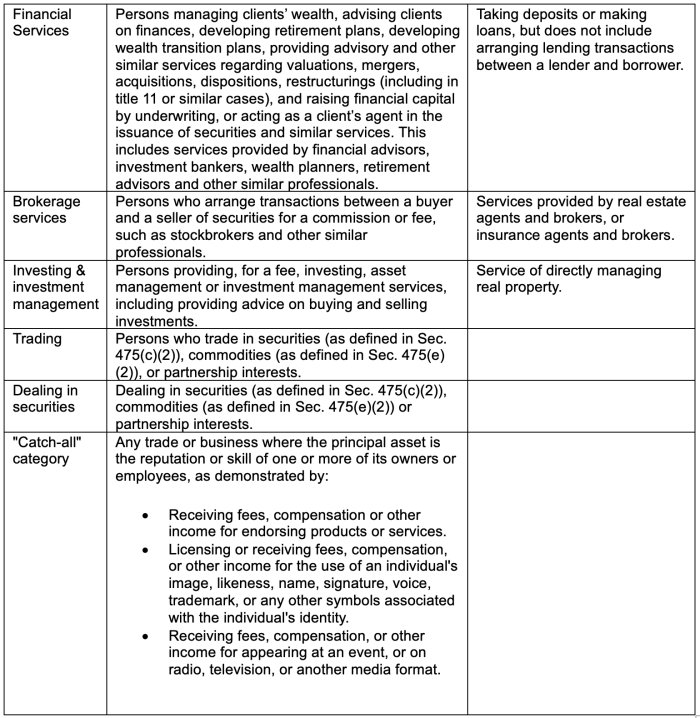

GreenTraderTax Comments on Section 475 Clean Up Project Copyright @ 2015 GreenTraderTax.com 1 Comments on IRS Section 475 Clean

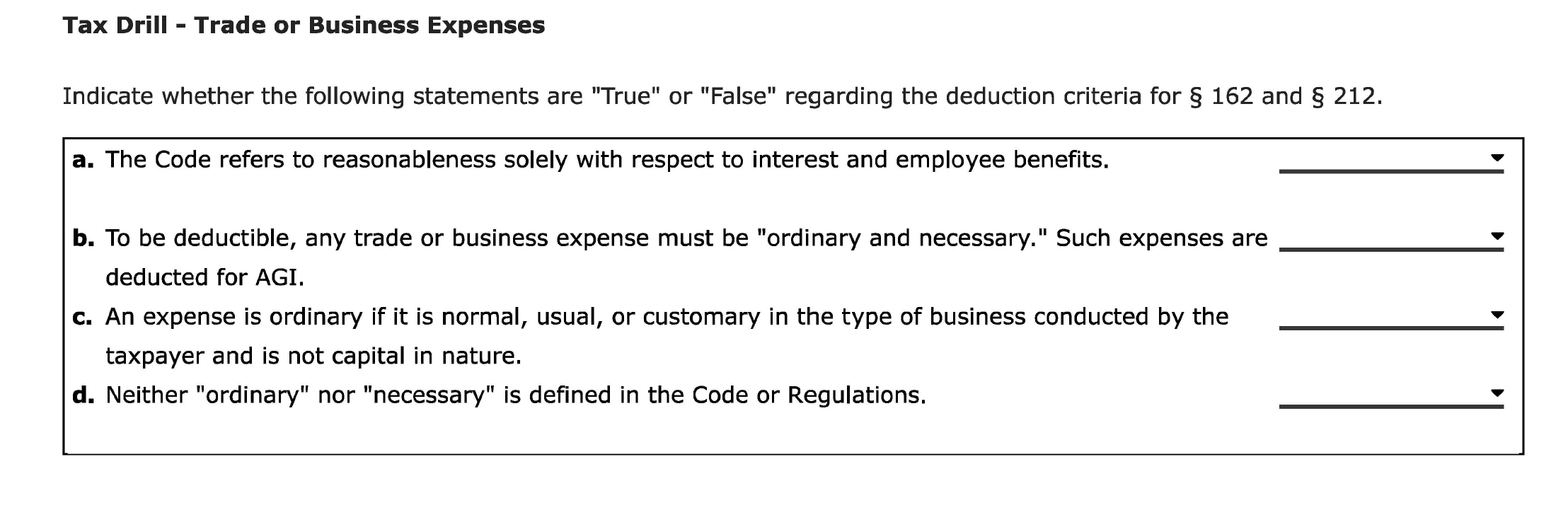

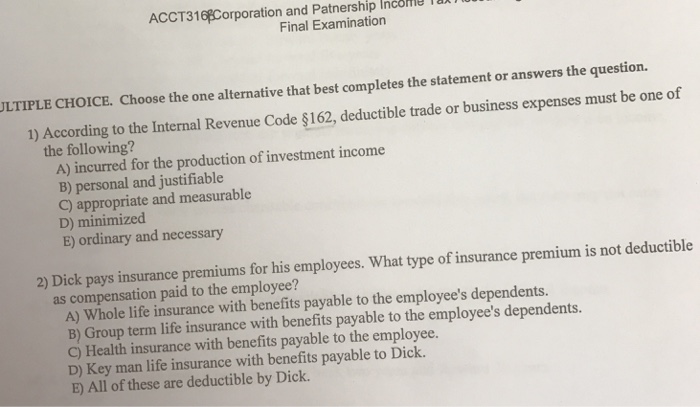

Part I Section 162.--Trade or Business Expenses 26 CFR 1.162-1: Business Expenses. (Also §§ 801, 831) Rev. Rul. 2008-8 ISSUES

Part I Section 162.--Trade or Business Expenses 26 CFR 1.162-1: Business expenses. (Also §§ 263, 263A; 1.263(a)-1) Rev. Rul.