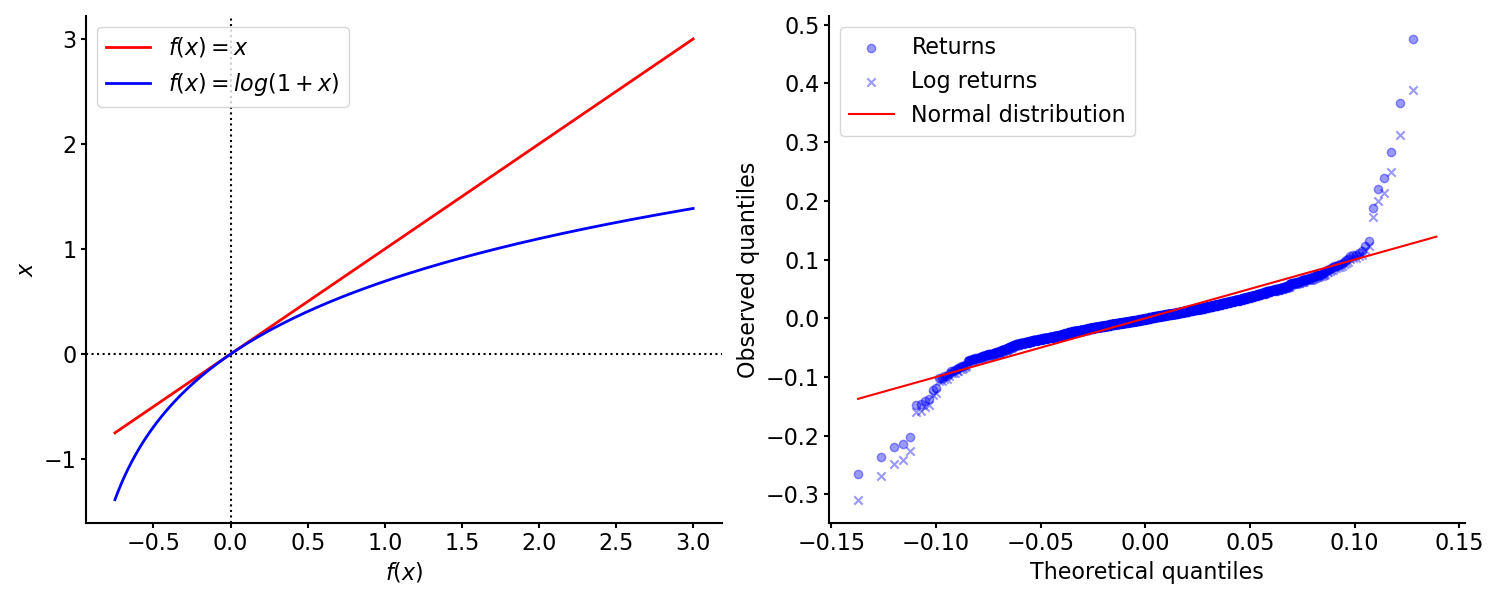

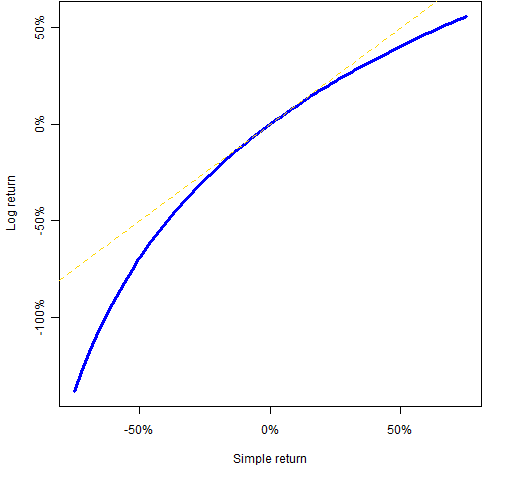

Why stock returns are calculated in Log scale? - General - Trading Q&A by Zerodha - All your queries on trading and markets answered

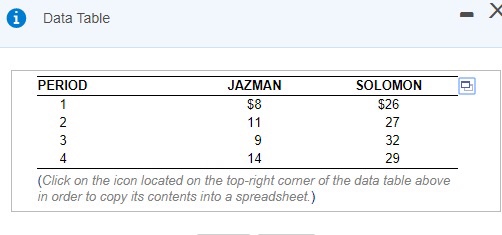

A tale of two returns | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

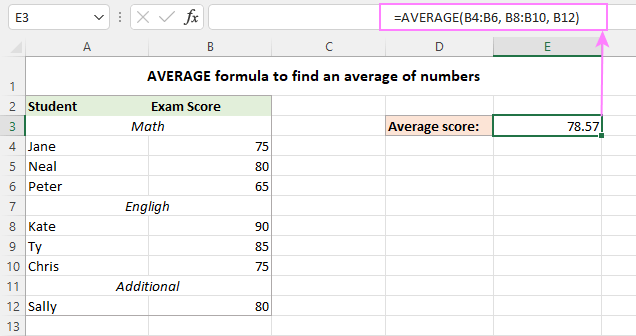

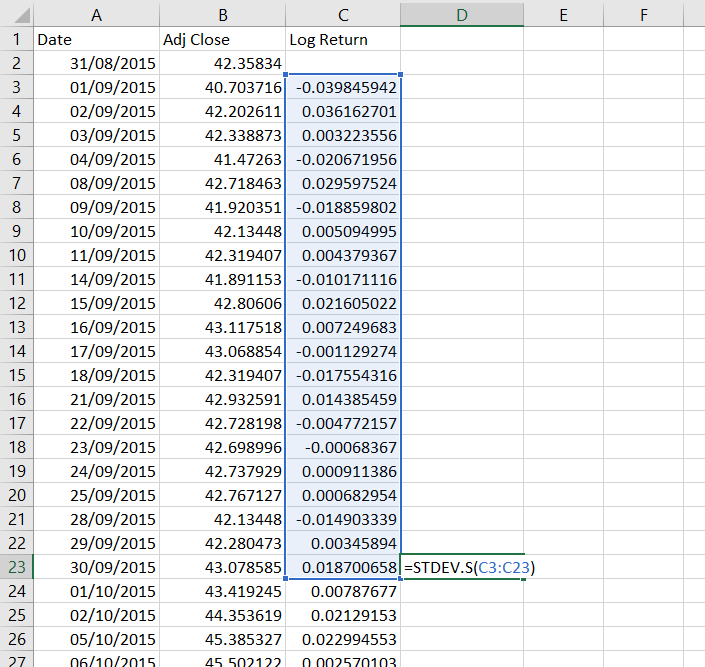

How to calculate Log return , daily return and Holding period return for stock market data - YouTube